Payday Loan can be managed with wise steps for better results

What You Required to Learn About Safeguarding a Payday Advance for Quick Money

Protecting a payday lending can offer instant monetary relief for unexpected expenditures. Nevertheless, customers have to browse a landscape loaded with high interest rates and rigorous eligibility demands. Recognizing just how these finances operate is crucial for making notified decisions. As people consider this alternative, they should evaluate the advantages against the potential threats. What are the covert prices, and exactly how can one responsibly approach this type of loaning? The solutions may be more complicated than they seem.

Comprehending Cash Advance Loans: Exactly How They Function

Payday advance are short-term, high-interest financings developed to give quick monetary alleviation to borrowers encountering unforeseen expenditures. Generally, these finances are made for percentages, commonly ranging between $100 and $1,000, and are suggested to be paid back on the debtor's following cash advance. The application process is simple; consumers can often apply online or in-person, needing very little documents such as proof of earnings and recognition. Upon approval, funds are disbursed quickly, often within hours.

The car loan quantity is normally established by the borrower's income level, ensuring that it is workable for payment within the short timeframe. Consumers must recognize the repayment terms, which usually entail a solitary repayment that includes the principal and rate of interest. While payday fundings can supply immediate help, they need cautious consideration to guarantee they align with the borrower's economic circumstance and settlement abilities. Recognizing these basic facets is important before proceeding with a payday advance loan.

The Prices Entailed: Rate Of Interest and Costs

Recognizing the expenses connected with payday advance is important for borrowers. This consists of an introduction of rate of interest, an assessment of covert fees, and a failure of payment costs. Each of these factors plays a substantial function in determining the general expense of getting a payday advance.

Rate Of Interest Summary

Rate of interest stand for a crucial element of the total expense connected with payday advance loan. Commonly, these rates can be substantially higher than those of standard car loans, usually ranging from 200% to 500% APR. This raised cost shows the temporary nature of payday financings, which are developed to link financial spaces up until the customer's following income. Lenders assess these rates based upon various elements, consisting of the borrower's credit reliability and state regulations. It is necessary for borrowers to comprehend that a high passion rate can result in a considerable settlement amount. As a result, people should thoroughly evaluate their ability to settle the car loan on time to avoid more financial strain. Eventually, comprehending passion prices is crucial for making informed borrowing decisions.

Hidden Charges Discussed

While lots of borrowers focus primarily on rates of interest when taking into consideration cash advance, hidden fees can greatly impact the complete expense of borrowing. These costs frequently include application costs, handling fees, and even late settlement charges, which can accumulate rapidly. Customers might not understand that some lenders bill costs for the ease of same-day financing or for extending the finance period. It is crucial for consumers to meticulously examine the funding agreement and ask the lending institution directly about any kind of prospective hidden costs. Transparency is key, as these added prices can significantly increase the general repayment quantity. Understanding all linked charges warranties that debtors make informed choices and avoid unforeseen economic strain.

Payment Prices Malfunction

Repayment of a payday advance loan entails not only the primary quantity borrowed however also different prices that can significantly influence the total monetary commitment. Rates of interest for payday advance are typically high, usually ranging from 200% to 400% annually, mirroring the short-term nature of these fundings. Additionally, customers might run into various charges, such as source fees or late settlement penalties, which can additionally blow up the total repayment amount. It is crucial for consumers to thoroughly assess the loan contract to comprehend all connected prices. Failing to pay off on time may result in rollovers, intensifying the monetary problem. Because of this, a thorough assessment of the settlement prices is vital for notified decision-making relating to payday advance loan.

Eligibility Requirements for Cash Advance Loans

When considering cash advance loans, potential consumers have to fulfill certain qualification demands. These include factors such as age and residency criteria, revenue confirmation procedures, and credit report factors to consider. Comprehending these demands is vital for individuals seeking to safeguard a payday advance loan successfully.

Age and Residency Standard

To certify for a payday advance, people have to meet details age and residency requirements that vary by state. Normally, candidates should be at least 18 years old, although some states may require individuals to be 21 or older. This age limit is designed to assure that customers are legally qualified of becoming part of an agreement. In addition to age, candidates should also be citizens of the state where they are seeking the car loan. The majority of lending institutions require evidence of residency, which can include paperwork such as an utility expense or lease agreement. Comprehending these criteria is crucial for prospective borrowers, as non-compliance can lead to denied applications or lawful problems. Constantly verify regional laws before using for a payday advance.

Income Verification Refine

Income verification is a vital action in the eligibility evaluation for payday advance loan, as lending institutions need to ensure that candidates have a reputable resource of revenue to repay the borrowed quantity. Commonly, borrowers should supply documents such as current pay stubs, bank declarations, or employment verification letters. This procedure helps loan providers examine the applicant's monetary security and payment ability. In addition, independent individuals may need to submit income tax return or revenue and loss declarations to show regular revenue. The confirmation procedure warranties that lenders alleviate the danger of default while additionally facilitating responsible lending practices. In general, satisfying the revenue confirmation requirements is vital for applicants seeking quick money with cash advance fundings.

Credit History Factors To Consider

Lenders usually analyze a candidate's credit report as component of the eligibility requirements for payday advance loan. While these car loans are normally created for individuals with less-than-perfect credit report, a greater credit history can enhance the possibility of approval and positive terms. Normally, loan providers search for a score above a certain limit, which may vary by establishment. A low credit report might lead to higher costs or rate of interest prices, showing the perceived risk connected with lending to individuals with poor credit report. Furthermore, some loan providers may not carry out credit report checks in any way, opting instead to review income and work status. Comprehending these variables can assist candidates prepare for the see here prospective obstacles of securing a payday lending.

The Application Refine: What to Anticipate

While maneuvering with the payday advance loan application process might appear intimidating, comprehending its vital elements can substantially simplify the experience. Usually, candidates start by providing personal details, including their name, address, and Social Security number. Lenders will also need details regarding work, earnings, and banking details to analyze the candidate's financial stability.

Once the initial info is submitted, the application may go through a fast evaluation process. Lots of loan providers supply on-line applications that can accelerate this stage, enabling faster authorization times. Some may even provide instant decisions, while others may take a over here couple of hours or days.

It is vital for candidates to check out the conditions and terms very carefully prior to settling the financing. Making certain that all details is full and precise will help with a smoother process. Eventually, being prepared and notified can result in a more efficient application experience, making it simpler to secure the required funds when needed.

Dangers and Risks of Cash Advance Loans

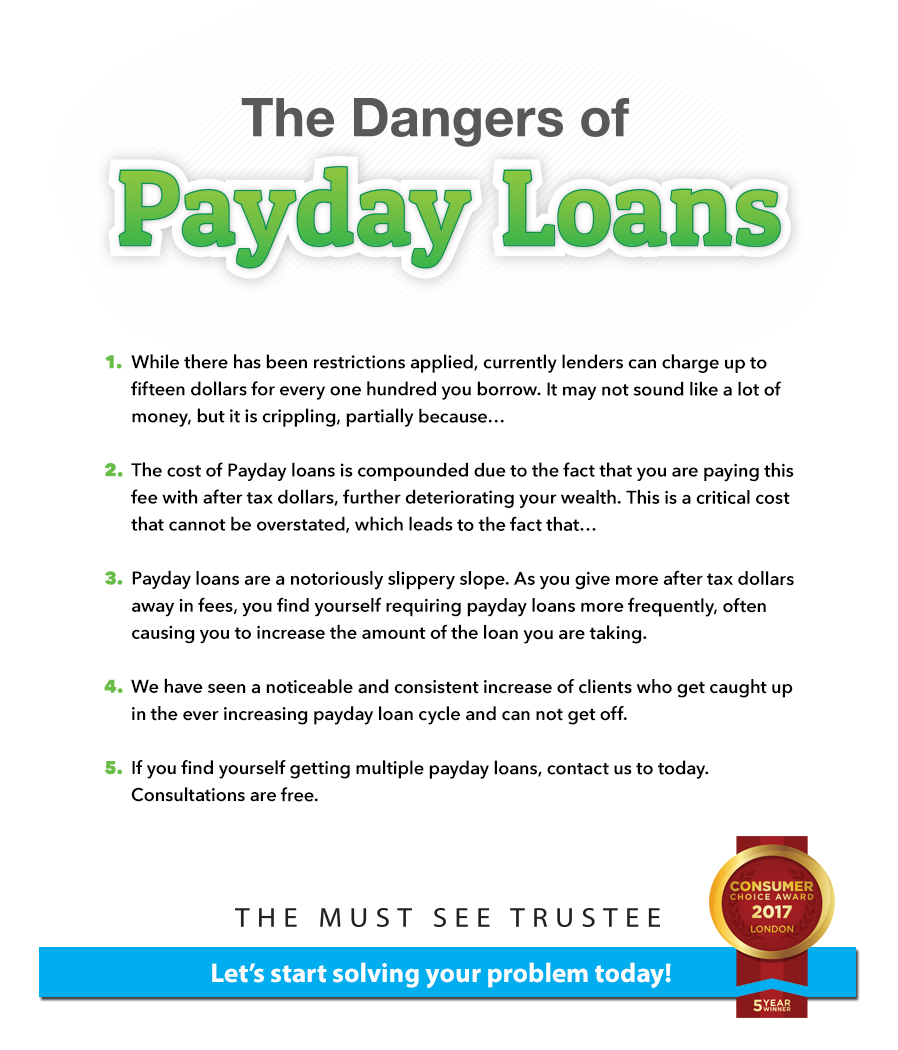

Steering the globe of cash advance includes fundamental risks that consumers have to very carefully think about - Payday Loan. One significant threat is the high-interest prices related to these fundings, which can result in a cycle of debt. Debtors typically find themselves incapable to pay off the initial quantity by the due date, motivating them to get additional finances, thus accumulating more costs and passion

Furthermore, cash advance finances can negatively affect credit ratings if settlements are missed or if accounts are sent out to collections. The brief payment terms can develop financial stress, specifically for those already encountering economic difficulties. Moreover, some lending institutions may use aggressive collection techniques, including tension and anxiousness to borrowers.

Inevitably, while payday financings may provide quick money remedies, the possible pitfalls necessitate careful consideration and an understanding of the long-lasting repercussions entailed.

Tips for Responsible Borrowing

Understanding the risks related to payday advance can assist borrowers make more educated choices about their financial alternatives. One vital pointer for liable loaning is to just secure a payday advance when absolutely needed, guaranteeing it is for a real economic emergency. Borrowers need to additionally examine their payment capability, considering their income and existing economic commitments to prevent a financial obligation spiral.

Alternatives to Cash Advance Loans: Discovering Your Alternatives

When confronted with financial emergency situations, people often seek quick services like payday advance; nevertheless, different options can supply relief without the high expenses connected with these fundings. One choice is a personal finance from a lending institution or financial institution, which typically offers lower interest rates and even more convenient repayment terms. One more alternative is obtaining from close friends or family members, which can minimize monetary strain and eliminate passion completely.

In addition, people may think about working out with lenders for prolonged layaway plan or reduced rate of interest rates, providing some breathing space without considering high-cost loans.

For those with minimal credit score choices, local charities and not-for-profit organizations commonly provide emergency monetary support programs. Ultimately, looking for a side gig or freelance job can produce added income to cover urgent expenditures. Discovering these options can aid individuals browse financial problems more sustainably and prevent the challenges of cash advance.

Regularly Asked Questions

Can I Obtain a Payday Advance Loan With Bad Credit Scores?

Yes, people with bad credit can acquire cash advances. Lots of lending institutions do not carry out click to find out more debt checks, instead focusing on revenue and settlement ability, making these finances available regardless of poor credit rating. Caution is encouraged as a result of high rates of interest.

Exactly How Swiftly Can I Obtain Funds After Authorization?

Are Cash Advance Loans Legal in All States?

Cash advance are illegal in all states. Laws differ substantially, with some states banning them entirely, while others impose rigorous standards. Individuals should research their neighborhood regulations to recognize the legitimacy of payday advance loan in their location.

What Takes place if I Can't Settle My Payday Advance in a timely manner?

If an individual can not repay a cash advance in a timely manner, they may sustain extra fees and interest costs, deal with debt collection initiatives, and potentially harm their credit rating, complicating future loaning opportunities.

Can I Obtain Several Cash Advance Loans Concurrently?

Yes, an individual can secure numerous payday advance loan concurrently, but this technique can lead to increased debt and financial strain. Lenders may additionally scrutinize the consumer's ability to settle multiple loans successfully.

Cash advance financings are temporary, high-interest car loans developed to offer fast financial alleviation to debtors facing unforeseen expenditures (Payday Loan). While cash advance loans can use prompt support, they need cautious factor to consider to ensure they straighten with the consumer's financial circumstance and payment capacities. Passion rates for payday car loans are commonly high, often ranging from 200% to 400% every year, showing the temporary nature of these loans. Understanding the dangers connected with payday finances can aid consumers make even more informed decisions about their financial options. When faced with economic emergencies, people often look for fast options like cash advance loans; however, numerous choices can give relief without the high costs associated with these fundings